Last Updated At: 01-Jul-2025

Secure Your Health in Thailand with Long-Term Coverage

Navigating healthcare as an expat in Thailand requires strategic planning. Thailand long-term health cover offers peace of mind for travelers and international residents seeking comprehensive medical protection in Southeast Asia's premier destination.

Expat health insurance Thailand has become increasingly sophisticated, providing robust medical coverage in Thailand that meets diverse healthcare needs. Understanding the local medical landscape helps individuals make informed decisions about their personal wellness strategy.

Protecting your health means selecting the right insurance package. International travelers and long-term residents can access world-class medical facilities through carefully chosen comprehensive health plans that offer extensive network coverage and responsive support.

Thailand's advanced healthcare system combines affordable treatment options with high-quality medical services. Professionals and retirees can confidently explore this vibrant country knowing their medical needs will be professionally managed through strategic insurance selections.

Smart travelers recognize that proactive healthcare planning prevents unexpected financial burdens. Comprehensive medical coverage ensures seamless access to top-tier treatment facilities across Thailand's urban centers and regional healthcare networks.

Understanding Thailand's Healthcare Landscape for Expats

Navigating the Thai healthcare system can be a complex journey for expatriates. Thailand offers a unique blend of medical services that cater to both local residents and international visitors. The country's healthcare infrastructure provides multiple options for medical treatment, ranging from public hospitals to world-class private clinics.

Public vs Private Healthcare Facilities

Thailand's healthcare system presents two distinct paths for medical care. Public hospitals Thailand offer affordable treatment options with basic medical services. These facilities typically serve local populations and provide essential healthcare at lower costs. In contrast, private clinics Thailand represent a more premium healthcare experience.

- Public hospitals: Budget-friendly, government-supported

- Private clinics: Higher-end services, English-speaking staff

- Wider range of specialized treatments in private facilities

Medical Tourism and Treatment Quality

Medical tourism Thailand has become a global phenomenon, attracting patients worldwide. The country's private hospitals boast state-of-the-art medical technologies and internationally trained physicians. Patients can access high-quality treatments at significantly lower prices compared to Western countries.

Healthcare Costs in Thailand

Cost-effectiveness remains a key advantage of Thailand's medical services. Expats can expect substantially lower medical expenses compared to their home countries. A routine doctor's visit or complex medical procedure often comes at a fraction of the price seen in the United States or European nations.

- Affordable medical consultations

- Competitive pricing for surgical procedures

- High-quality medical equipment and expertise

Thailand Long-Term Health Cover Essential Benefits

Expats in Thailand can protect their health and financial well-being through comprehensive medical coverage that offers extensive long-term health insurance benefits. Understanding the critical features of expat health plan features becomes crucial for anyone planning an extended stay in the country.

The right long-term health insurance provides a comprehensive medical coverage Thailand residents can rely on. These plans typically include a range of critical healthcare services designed to meet the unique needs of international residents.

- Inpatient hospital treatments covering medical procedures and extended care

- Outpatient services including specialist consultations and diagnostic tests

- Emergency medical evacuation for critical situations

- Preventive care screenings and annual health check-ups

- Prescription medication coverage

Expatriates benefit from tailored health insurance plans that address potential medical challenges. These comprehensive packages ensure access to high-quality healthcare facilities across Thailand, protecting individuals from unexpected medical expenses.

Specialized long-term health insurance benefits extend beyond basic medical treatment. They often include dental coverage, mental health support, and options for international medical treatment if needed. Expats can customize their plans to match individual health requirements and budget constraints.

Selecting the right health insurance plan requires careful consideration of personal health needs, potential medical risks, and financial capabilities. Thorough research and comparison of different insurance providers will help expats find the most suitable comprehensive medical coverage in Thailand.

Choosing the Right Insurance Provider in Thailand

Selecting the right insurance provider is crucial for expats seeking comprehensive health coverage in Thailand. The landscape of international health insurance Thailand offers multiple options that can meet diverse healthcare needs.

Navigating the world of Thai insurance providers requires careful consideration of several key factors. Expats must evaluate different approaches to finding the most suitable health protection strategy.

Local vs International Insurance Companies

Expats can choose between local and international insurance companies when securing health coverage. Each option presents unique advantages:

- Local Thai insurance providers often offer more affordable rates

- International health insurance companies provide broader global coverage

- Multinational plans typically include more extensive hospital networks Thailand

Coverage Network and Hospital Access

Understanding hospital networks is critical for comprehensive health protection. Top insurance plans should offer:

- Wide range of accredited medical facilities

- Direct billing options at major hospitals

- Emergency medical evacuation services

Policy Renewal and Age Restrictions

Expats must carefully review policy renewal options and potential age-related limitations. Some key considerations include:

- Renewal terms and conditions

- Potential premium increases with age

- Coverage continuity for long-term residents

Researching and comparing different insurance providers will help expats find the most suitable health coverage for their specific needs in Thailand.

Common Exclusions and Policy Limitations for Thai Health Insurance

Navigating health insurance exclusions in Thailand requires careful attention. Expats exploring medical coverage often encounter specific policy limitations that can catch them off guard. Health insurance exclusions Thailand typically include pre-existing conditions, which remain a critical consideration for international travelers seeking comprehensive medical protection.

Policy limitations expat insurance frequently restrict coverage for certain high-risk activities and elective procedures. Cosmetic surgeries, experimental treatments, and sports-related injuries often fall outside standard insurance plans. Individuals should meticulously review documentation to understand exactly what their specific policy will and will not cover before making any medical decisions.

Pre-existing conditions coverage varies dramatically between insurance providers. Some companies offer limited protection with waiting periods, while others may require additional premiums or completely exclude such medical scenarios. Experienced expats recommend obtaining detailed documentation and discussing specific health concerns directly with insurance representatives to ensure maximum potential coverage.

Strategic planning becomes essential when selecting healthcare protection in Thailand. Potential policyholders should compare multiple insurance options, evaluate their personal health risks, and select plans that provide the most comprehensive protection within their budget constraints. Understanding these nuanced policy details can prevent unexpected financial burdens during medical emergencies.

--- Published By Adotrip

Latest Blogs

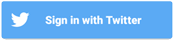

One Day Picnic Spot Near Vadodara - Nature, Heritage & Adven...

One Day Picnic Spot Near Panvel - Relax, Explore & Refresh

One Day Picnic Spot Near Nashik – Lakes, Hills & Heritage

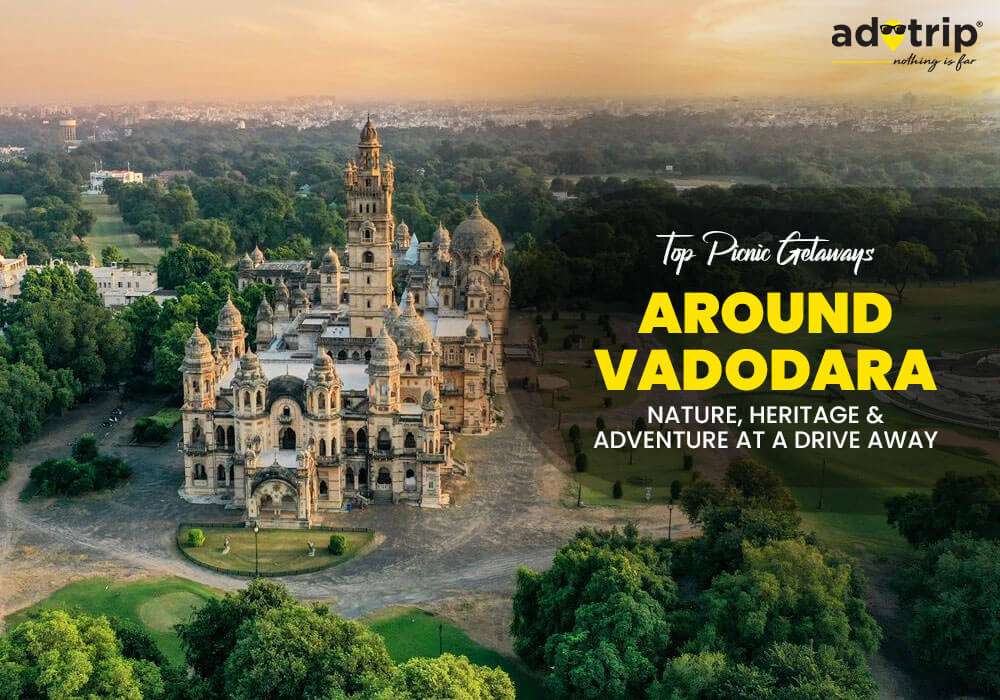

One Day Picnic Spot Near Karjat – Nature, Adventure & Weeken...

Dubai

Dubai Malaysia

Malaysia USA

USA